Bigger, stronger and cheaper: growth in e-cigarette market driven by disposable devices with more e-liquid, higher nicotine concentration and declining prices

Abstract

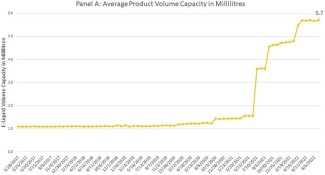

Objective: This study explores trends in the disposable e-cigarette market in the USA, specifically focusing on changes in e-cigarette size, nicotine strength, and real sales-weighted average prices, both per e-cigarette unit and per volume of e-liquid.

Methodology: NielsenIQ retail scanner data from January 2017 to September 2022 was used to analyse shifts over time in product volume capacity (mL), nicotine strength (%), and both unit and volume-based average prices over each 4-week period.

Results: Between January 2017 and September 2022, the average e-cigarette volume capacity increased by 518%, from 1.1 mL to 5.7 mL, while nicotine strength rose by 294%, from 1.7% to 5%. The average price per disposable unit and per mililiter of e-liquid remained relatively stable until January 2020. From January 2020 to September 2022, the average price per unit increased by 165.7%, from $8.49 to $14.07, whereas the price per mL of e-liquid decreased by 69.2%, from $7.96 to $2.45.

Conclusions: Current regulatory policies have led to disposable e-cigarette manufacturers offering larger, cheaper products with higher nicotine strengths. To regulate the market more effectively, it is recommended that policies include restrictions on e-liquid capacity, minimum pricing laws, and regulations on product characteristics such as nicotine strength, nicotine output, device power, and puff duration.